Calculate how much interest and principle you’ve paid on your mortgage. Calculate the payback schedule for loans and mortgages using this Amortization calculator. The computation result will display the entire mortgage Amortization plan, complete with a payment table that displays monthly interest and principle payments. Calculate your monthly mortgage payment with Smart Asset’s mortgage calculator, which includes principal, interest, taxes, homeowners insurance, and private mortgage insurance (PMI). To see how your monthly payment would change, alter the home price, down payment, and mortgage conditions.

If you’re not sure how much money you should spend for a new home, you can use our how much house can I afford tool.

A financial expert can help you plan for your house purchase. Try our free online matching tool to find a financial advisor in your area.

Free mortgage amortization calculator?

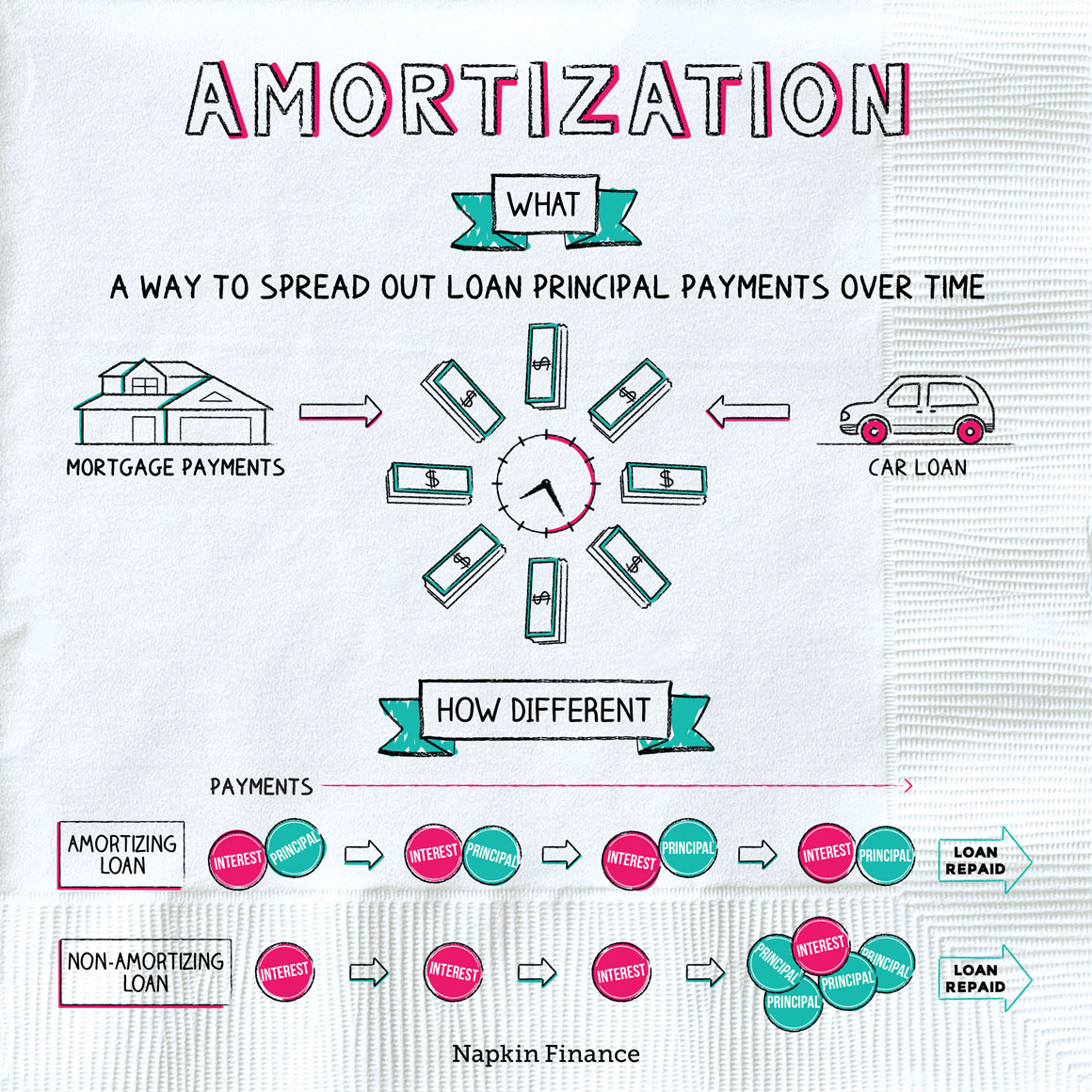

The act of paying down a loan’s debt over time is known as “Amortization.” There is one payment for each month of the loan term in the event of a mortgage (say 30 years). The loan sum is reduced each time the borrower makes a payment, allowing the loan to be amortized . The loan has been fully amortized at the end of the period, and the balance is $0.

Try this interactive Amortization calculator to discover how it works. Below is a simple example and explanation of how the Amortization table is calculated.

How Do You Calculate Amortization?

Homeowners can calculate their mortgage Amortization by entering their information into an Amortization calculator, which calculates your monthly mortgage payments using a formula.

You can use an Amortization calculator to:

· Calculate the amount of principle and interest paid in any given instalment.

· Calculate the total amount of principle and interest paid on a given day.

· Determine the amount of principal owed now and in the future.

How to use Credit Karma’s loan amortization calculator

It’s helpful to get an estimate of your monthly payment and the total amount you’ll pay in principal vs interest when considering how much to borrow or comparing loans. Use our loan Amortization calculator to see how different loan terms affect your payments and the amount of interest you’ll pay. You can also look at an Amortization plan to see how the percentage of your monthly payment that goes to interest changes over time.

Remember that this calculator simply gives you an estimate based on your inputs. It ignores other factors such as mortgage closing costs and loan fees, which could increase your loan amount and monthly payment. It also ignores the variable rates that come with adjustable-rate mortgages.

What’s behind the numbers in our mortgage amortization calculator

You can use an Amortization calculator to see how much interest and principal (the debt) you’ve paid in each given month of the loan. The term “Amortization” refers to the method of repaying debt in a mortgage when each monthly payment is the same (excluding taxes and insurance). The majority of each payment goes toward interest in the early years, with only a little portion going toward debt reduction. This ratio shifts with time, eventually flipping in the last years of the loan. At work, this is Amortization

How to use our mortgage amortization calculator

You can customize the mortgage Amortization calculator with your own numbers to get the most out of it. Fill in the data fields on the graph’s right side.

The following inputs can be found in the data fields:

- The house’s worth or price.

- The interest rate on a mortgage.

- The down payment (or the value of the home’s equity in the case of a refinance).

- The loan’s length might range from one to thirty years.

The calculator has four tabs:

- The graph is called “Amortization schedule.” To see how much you still owe and how much principal and interest you’ve paid at the conclusion of each 12-month period, move the vertical slider.

- “Breakdown” displays the remaining loan sum month by month after that payment has been made. It also shows a mortgage Amortization table on computers and tablets, which shows the principal and interest paid each month.

- The projected monthly payment, which includes principle and interest, property taxes, and homeowners insurance, is shown under “Monthly payment.”

Amortization Calculator Results Explained

When you enter all of the required information into the Amortization calculator, it will calculate the monthly payment, total remaining balance, total principal, and total interest paid.

- The calculator utilizes the following numbers to arrive at these conclusions:

- The loan amount is the principal sum of your mortgage, excluding interest, that you owe to the lender.

- The interest rate is a percentage of the loan amount that borrowers must pay on top of the mortgage payment.

- The loan term refers to the length of time it will take to repay the mortgage.

Your mortgage payment will cover the interest at first, then gradually reduce the amount you owe on your home loan over time. It’s crucial to note, however, that this does not include additional household costs like insurance, property taxes, or utilities.

The Bottom Line

When you get a mortgage, you’ll be bombarded with numbers. Review your Amortization schedule as soon as possible. It’s critical to know how much you’ll pay each month for the duration of your loan.

By calculating how much of each of your payments goes toward interest, especially in the early days of your loan, you may be motivated to pay more each month to reduce your principal balance.